said that the rescue plan would lead the U.S. down “the road to socialism.” If only.

said that the rescue plan would lead the U.S. down “the road to socialism.” If only.

Home Mail Articles Supplements Subscriptions Radio

The following article appeared in Left Business Observer #118, December 2008. Copyright 2008, Left Business Observer.

Gloomy, w/ a 15% chance of depression

LBO has often described the U.S. economy by invoking the old Timex watch slogan from the 1950s, “Takes a licking and keeps on ticking.” Crash follows upon panic follows upon bust, and yet the thing keeps getting up again to binge some more. These remarkable feats of renewal, though, have always come with big help from the U.S. government, either multibillion dollar bailouts or long rounds of indulgent monetary policy from the Federal Reserve. But revive it always has, despite the forecasts from the hard left and the hard right that this time it was different and the medicine just won’t work.

Will it work again? Will the megadoses of stimulus do the trick? Or is the jig up? Will what’s widely touted as the greatest financial crisis since the 1930s be a prelude to Great Depression II?

As this is written, the punters on the Intrade betting site—who have an uncanny history in predicting elections—are giving depression a 15% probability. That seems about right. [Note added for web: the value of the web contract soared in the weeks after these words were written. As this note is added, the contract is at 53. That seems too high, but you never know, do you?]

Before proceeding, a little reminder of how we got to this sorry pass. People borrowed gobs of money to buy houses they couldn’t afford, and then borrowed additional gobs against the rising value of those houses. All that borrowing was the result of a toxic mix of misplaced optimism, outright fraud, and quotidian necessity.

But, as they say on TV, that’s not all. Wall Street, which can never let well enough alone, enabled all this mad borrowing in at least two ways. The first was securitization—packaging multiple mortgages into bonds, which were then sold to institutional investors, thereby bringing forth a cornucopia of funds for further lending. And second, they also packaged mortgages, from solid to rocky, into a raft of synthetic securities that hid the full extent of the risks from people who should have known better—the professional money managers who bought all those wacky derivatives that have now blown up. And a lot of those money managers were operating with borrowed money, often large quantities of it.

The last two paragraphs are intended not just for the analytical scene-setting, but to make an essential economic point. Some progressive pundits and politicians have argued that any government bailout should be aimed at debtors, not banks—underwater mortgages, not toxic derivatives. It would be nice if we had that choice. But sadly, the finest minds of Wall Street added to all those underwater mortgages layer upon layer of opaque and leveraged structures that are now sources of major mischief in themselves. That means that any plausible bailout has to attack both parts of the problem. Since the history of financial crises shows that speed of response is crucial, and since it will take a long time to sift through several million upside-down mortgages, the wobbly financial superstructure has to take precedence—in time, not importance.

Support for a quick response comes from a very useful review by two IMF economists, Luc Laevan and Fabian Valencia. Their work isn’t standard-issue IMF ideology, but a historical database of 124 banking crises around the world since 1970—causes, resolutions, costs.

Laevan and Valencia show that some sort of systemic restructuring is a key component of almost every banking crisis, meaning forced closures, mergers, and nationalizations. That’s already well underway. Shareholders frequently lose money in systemic restructuring, often lots of it, and are even forced to inject fresh capital. We’ve also seen some of that. The creation of management vehicles to buy up and eventually sell distressed assets (either financial assets like loans or real ones like strip malls or housing tracts) is a frequent feature of restructurings, and central to Paulson’s initial plan, but such schemes do not appear to be terribly successful. More successful are recapitalizations using public money—meaning that the government injects funds into the banks in exchange for stock. (Belatedly, the Paulson administration embraced this approach.) Such stock is usually sold off, often at a profit, when the banks return to health, though of course a government with socialization on its mind could keep it. And Laevan and Valencia also find that relief for troubled debtors—reducing either the principal or interest on their loans, or both—also helps an economy get out of a financial crisis. This is a nice coincidence of economic efficiency and social justice.

These bailouts are not cheap: based on the experience of other countries, our bill should reach several hundred billion dollars. Sweden’s approach is often taken as a model. That country experienced a mad credit and real estate boom in the late 1980s, after its tightly regulated financial system was deregulated. The bubble burst in 1991, and the government stepped quickly in to support the banks. The initial outlay amounted to 3.6% of GDP, which would translate into about $500 billion for the U.S. But as the banks returned to health, the government sold its shares, recouping almost 95% of its outlays. It’s not likely we’ll be that lucky, but you never know.

Those who don’t want to spend that kind of taxpayer money should consider this: Laevan and Valencia find that “[t]here appears to be a negative correlation between output losses and fiscal costs,” suggesting that the cost of a crisis is paid either through fiscal costs or larger output losses. What you save on bailout expenditures you more than lose in a deeper recession. Not that you can avoid recession entirely: Sweden had one, and so are we.

Paulson’s original proposal was ludicrous—all 840 words of it (the length of a typical newspaper column). He originally proposed to give himself total discretion over the expenditure of $700 billion without even the potential for judicial review. Even if Congress was motivated by an insult to their institutional narcissism rather than principle, this was clearly too much to ask. So they added an oversight board and limits on executive pay (which Paulson objected to).

But then the House initially rejected their own improved product. Most of the opposition came from the Republican right, though some of the more leftish Democrats helped out. Republican complaints were delusional; one of the leaders of the right flank of the anti-bailout camp, Jeb Hensarling of Texas said that the rescue plan would lead the U.S. down “the road to socialism.” If only.

said that the rescue plan would lead the U.S. down “the road to socialism.” If only.

If the right opposition was delusional, the left opposition flirted with the juvenile. There were some hyperradicals who wanted no bailout because they want the whole system to come crashing down. That’s not politics—that’s nihilism. But less exuberant sorts also said some troublesome things. “We” shouldn’t be handing money over to Wall Street—instead we should be spending it on schools and green jobs. Yes, it would be lovely to spend lots of money on schools and green jobs. We’re even going to get some of that—but it wouldn’t address the financial crisis. A busted credit system is a very serious problem for everyone, not just the bourgeoisie.

A number of progressive “no” proponents even denied there’s any real financial crisis. They argue that it’s a hoax, a shakedown, to transfer a few hundred billion from taxpayers to bankers. It would be helpful if those arguing for this position knew anything about finance or economics, but the closest thing to evidence offered by some proponents of this position is a citation of Naomi Klein’s problematic The Shock Doctrine. Even Klein herself flirts with this point of view.

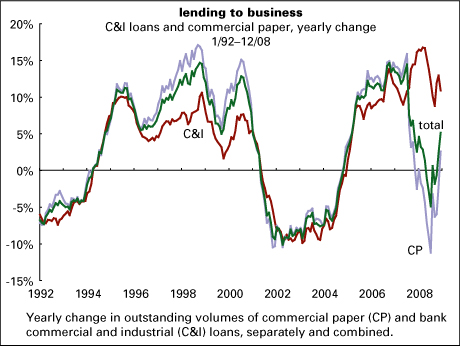

It’s one thing to misread history; it’s another to use that misreading to misread the present. The crisis is real. The credit markets are frozen. Even the normally admirable Dean Baker claimed that there is no credit crisis because interest rates are low. Leaving aside the fact that not all interest rates are equally low—junk bonds are at historic highs—the main problem isn’t the price of credit, interest rates, but its availability—whether you can get a loan. And getting a loan is tough: mortgages and even auto loans are hard to come by, and banks are about to cut back on credit card spending limits. Ordinary lending to business for day-to-day operations—the credit that allows manufacturers to buy raw materials and retailers to stock the shelves with inventory—present a mixed picture.  One part of the market, commercial paper—the unsecured short-term borrowing by big, blue-chip companies—virtually ground to a halt for a year, but a new Fed program to stimulate the market is having an effect. So-called commercial and industrial lending by banks hasn’t dried up, but growth is slowing. If it slows much more, the economy will grind to a halt.

One part of the market, commercial paper—the unsecured short-term borrowing by big, blue-chip companies—virtually ground to a halt for a year, but a new Fed program to stimulate the market is having an effect. So-called commercial and industrial lending by banks hasn’t dried up, but growth is slowing. If it slows much more, the economy will grind to a halt.

It is absolutely essential that this not happen. One of the things that made the Depression of the 1930s Great was the collapse of 10,000 banks between 1929 and 1932. Savings were wiped out, and the machinery of credit creation, which provides an essential nutrient for the real economy (it’s not all “speculation,” though it may look that way sometimes), seized up. Fed chair Ben Bernanke made his academic reputation by analyzing the contribution of bank failures to the economic collapse of the early 1930s, and that is no doubt one reason he’s been extremely active in trying to prevent a rerun. But the Fed can’t do it alone; saving the banks requires the expenditure of real money.

No banks, no economy.

That’s not to say that even the “improved” structure of the bailout is a great thing. Paulson has run it erratically. First he wanted to buy only bad assets. Apparently someone told him that equity infusions have a better history, so he changed his mind and started buying stock in troubled banks. Then he announced that that was all he was going to do—no troubled asset purchases at all (even though the official name of the bailout is the Troubled Assets Relief Program—but maybe they just liked the acronym).

That’s not to say that even the “improved” structure of the bailout is a great thing. Paulson has run it erratically. First he wanted to buy only bad assets. Apparently someone told him that equity infusions have a better history, so he changed his mind and started buying stock in troubled banks. Then he announced that that was all he was going to do—no troubled asset purchases at all (even though the official name of the bailout is the Troubled Assets Relief Program—but maybe they just liked the acronym).

But despite the rocky history of bad asset purchases, you could argue that they made sense in this case, since no one really knows what a lot of snazzy mortgage derivatives are worth. No one’s buying or selling them, so there’s no market price. That uncertainty is part of what’s got the credit markets in a funk; no one knows if the guy on the other side of the trade is good for the money, and no one really knows how much his own institution is worth. Presumably government purchases of some of these bad assets could have put some sort of floor under prices and gotten things moving again. But Paulson’s not doing them now. Gary Ackerman, the Democratic Congressman from Queens, got it right when he said that Paulson gave the impression that he’s flying a $700 billion plane by the seat of his pants.

We could do better than that. So let’s look at how we might—first, in the “realistic” sense, fully aware of the constraints of American politics, and then in a more fanciful sense, of what we might could do to make this a better world.

Paulson has bought equity in banks, but of the nonvoting sort. It’s stunning that the auto industry is being forced to accept an oversight board and the likely disemployment of its CEOs for $25–50 billion, while finance is getting something like twenty times that much with nary a concession. Existing management should go, and finance must be re-regulated (on which more in a moment).

Debtors must be relieved. This isn’t only a matter of social justice, it’s good orthodox economics, as the IMF economists Laevan and Valencia showed (though, sad to say, it doesn’t poll very well). With all the complexities of securitization—it’s no easy matter tracing the route from debtor to ultimate creditor, and the legal complications of breaking up pools of securitized assets are a real headache—this is easier said than done, but that’s no excuse for not doing it.

And finance must be re-regulated. It’s reasonable that that wasn’t considered in the first cut at the bailout; figuring out how to regulate this massively complicated financial system is no easy matter. But it’s got to be done.

Finance has gotten so complex and internationalized that it would take lots of time and negotiation even to get a start on things. The old Bretton Woods system, established at the end of World War II, was based on a world of fixed exchange rates, tight capital controls, and unchallenged U.S. dominance.

Now exchange rates float, capital moves more freely than people, and the U.S., while mighty, is hardly unrivalled. And that rivalry is no longer just about Western Europe and Japan—there are also what Wall Street calls the BRICs: Brazil, Russia, India, China. Just for starters. It’s difficult to see how a group of countries with different systems and interests can cede enough sovereignty to an international body to allow regulation to work without an almighty hegemon (like the U.S. of 60 years ago) knocking heads together.

Which brings up another matter: what kind of regulation should the global left, such as it is, call for? Is the point to make the system work better, in the sense of being less crisis prone and more humane? Or is the point to renovate the whole thing? Could a wholesale renovation happen without the existing order collapsing or being torn down? Would we want to throw several hundred million out of work with the vague hope of making things better? Just who is this left anyway, and what power do we have? Is our constituency the poorest of the world, to whom the financial system means next to nothing, or the middle ranks who have something but are always at risk of losing it—or the more enlightened elements of the bourgeoisie? All three? Or is it just idle wankery to dream that “we” have any influence, or that such a “we” even exists?

That’s all very interesting, but let’s ignore it for now—put it under erasure, as the wily deconstructionists say.

Waxing more utopian, you can take that further and say that banking is rather like an old-style utility—something so essential to all of us that it should be regulated like electricity used to be before the preposterous experiment with utility deregulation. And if the government is bailing out and nationalizing banks and other financial intermediaries, why not keep some of them in the public sector? Why not use them to fund real economic development in neighborhoods starved for capital? Why not extend low-cost financial services to poor people who are now fleeced by check-cashing services and payday lenders?

Yeah, this is American capitalism, where we only socialize losses, never gains, but we can dream, can’t we?

No more dreaming. What we’re likely to get is a rejiggered TARP, with maybe some voting stock, more pressure on the banks to lend (though is that what an over-indebted economy really needs?), and foreclosure relief along with a giant stimulus program.

As you’ve probably heard, there’s a new regime taking over on January 20. And however much appointments like Larry Summers and Robert Gates contradict the Obama brand’s principal selling point, “Change!” (about which LBO can only say, “We told you so!”), it must be admitted that the likely stimulus program looks half decent in both size and content. It’d be nice to see some social spending and redistribution too, but it’s no surprise that this gang isn’t proposing that. Infrastructure spending, green energy, and aid to state and local governments are all good things, and will have a salutary economic effect, too.

But there are some contradictions to consider, aside from personnel vs. campaign slogans. One is financing. Almost everyone assumes that the U.S. will have little trouble raising hundreds of billions for its bailout and stimulus schemes. What if it finds selling all those bonds a little rough? Could the U.S. be someday perceived as a credit risk like Italy, only much bigger? Say this forces interest rates up—what would this do to the private economy, finanical and real? This is not likely to happen, but it’s not at all impossible.

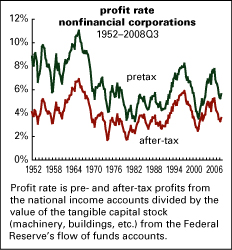

And then there are the contradictions that credit resolved for a while. Much of the restoration in corporate profitability from the early 1980s through the late 1990s—a trend that sagged in the early 2000s, then returned, though not as magnificently as before—came from squeezing labor harder—wage cutting, union busting, outsourcing, and the rest of the familiar story.  All this constrained purchasing power in an economy that thrives on mass consumption. What wage incomes couldn’t support got a lift from borrowing—credit cards first, then mortgages. The credit outlet is now shut, and will be for quite a while, forcing consumption to depend on wage income, which is shrinking. Capital will want to squeeze labor harder to restore profitability, but consumption won’t have credit to help it out.

All this constrained purchasing power in an economy that thrives on mass consumption. What wage incomes couldn’t support got a lift from borrowing—credit cards first, then mortgages. The credit outlet is now shut, and will be for quite a while, forcing consumption to depend on wage income, which is shrinking. Capital will want to squeeze labor harder to restore profitability, but consumption won’t have credit to help it out.

You could argue that this is exactly what the U.S. needs in orthodox terms: to invest more and consume less. Investing more means directing more cash into things and certain kinds of people (engineers rather than brand consultants) and less into Wall Street’s pockets (which ultimately means the American rich). This is a very different economic model from what we’ve been used to. It’s probably not what a working class that has experienced 35 years of flat-to-declining real wages wants to hear. A more humane way to go about reducing consumption would be taxing rich people, who still have lots of money; some of it could be given to the less rich, and other of it to funding the bailout and stimulus programs. That’s not in our present politics, but politics could change.

There’s a lot of talk about how this crisis marks the end of the neoliberal era, which it may be, and also portends the return of the state, which is a little more complicated.

Neoliberalism, a word that’s more popular in the outside world than in the U.S., took hold in the early 1980s. Its most prominent feature is an almost religious faith in the efficiency of unregulated markets. The ideal is—was?—to make the real world resemble the financial markets as much as possible, with continuous trading at constantly updated prices, with allegedly self-regulating markets determining the allocation of both money and stuff. To do that requires the commodification of everything, including water and air. Much of that agenda was successfully accomplished.

Though it fantasizes itself to be antistatist, neoliberalism was nonetheless accomplished only with a heavy hand of the state. It couldn’t have happened had the Federal Reserve under Paul Volcker not raised interest rates towards 20%, producing a savage recession that scared labor into submission and drove the world’s debtor countries into the arms of the IMF. It couldn’t have happened if the IMF, a body of states, hadn’t forcibly supervised the innumerable rounds of austerity, privatization, and market openings that were the “solution” to the debt crisis. It couldn’t have survived the repeated state bailouts that rescued the financial system whenever it hit a wall.

Now the financial system has hit a giant wall. While the world’s states will probably succeed in preventing total disaster, there looks to be something end-of-the-lineish about this wall. Even very conventional people on Wall Street, like ISI’s Andy LaPerriere, are talking about “the crisis of an economic paradigm.” To him, this moment is very much like 1980, only instead of Reaganism, we’re seeing the dawn of a “new Democratic era.” But these Democrats—who are basically what David Smick calls “hedge fund Democrats”—don’t have anything matching the transformative agenda that Reagan (a real mov ement conservative) did.

ement conservative) did.

From that, it’s possible to see a reconstitution of the American elite, from a gang of neo-Gilded Age freebooters into something more organized—a new Progressivism that would owe as much to Teddy Roosevelt as Franklin. But both those Roosevelt eras were shaped by radical agitation as much as elite reconstitution. We have little of that now.

But, to return to the first of the contradictions listed above, many people who voted for “Change!” are instead getting a slicked up version of the status quo. That’s likely to lead to some disappointment—a potentially productive disappointment. The sense of possibility that Barack Obama has awakened is a very dangerous thing.

Back in the Gorbachev days, the anticommunist right loved to quote Tocqueville saying that the riskiest time for a bad regime is when it starts to reform itself. That’s where our regime is right now, and it’s a good time for us, whoever we are exactly, to go out and make it riskier. It’s going to get easier to win recruits as the ranks of the disappointed swell.

Home Mail Articles Stats/current Supplements Subscriptions Radio